Weinberg Capital Partners sells its majority ownership in REALEASE Capital to Qualium Investissement

Weinberg Capital Partners announced the sale of its majority ownership in REALEASE Capital to Qualium Investissement. The transaction’s completion is subject to approval by the competition authorities.

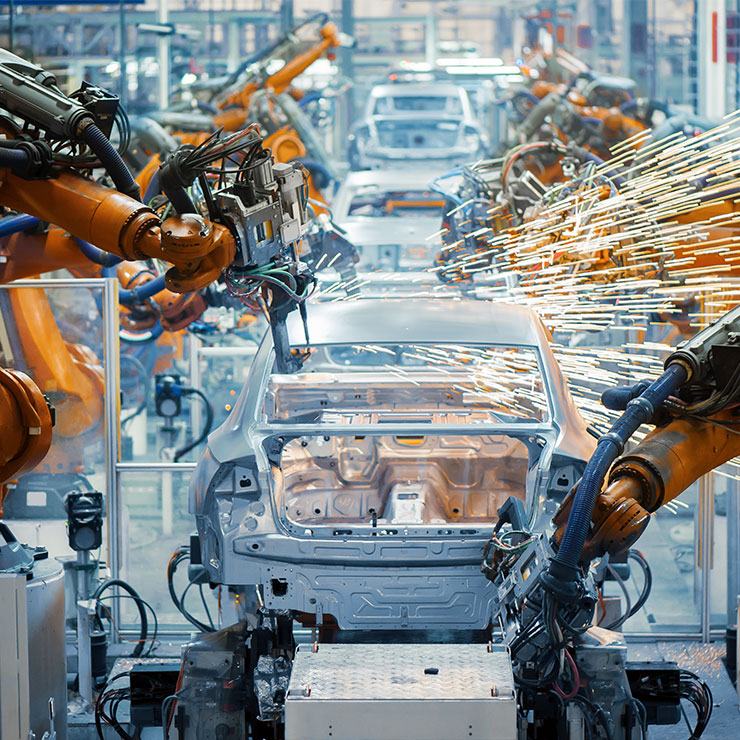

REALEASE Capital is the leading independent pure-player of the equipment leasing market in France. The Group offers tailor-made financing solutions through a complete and agnostic leasing offer (financial lease, operational lease, etc.) backed by a wide range of financing methods (contract assignments, credit structuring, self-leasing, etc.), all this being complemented by high value-added services (insurance, evolving contracts, etc.).

With an excellent reputation and legitimacy built up over more than 30 years, the Group has privileged relationships with its pool of funders and its 800 selected suppliers serving more than 7,200 SME end-clients. At the end of 2022 the Group financed €500m worth of equipment throughout c.11,000 contracts.

Since the investment of Weinberg Capital Partners in late 2018, REALEASE Capital has doubled both its EBITDA and turnover, which is around €170m. In the same timeframe, the Group has led a successful management transition and digitalized the full range of its service offering and internal processes. The workforce has grown by close to 40%, notably with key recruitments among the executive management and sales teams.

About Weinberg Capital Partners

Founded in 2005, Weinberg Capital Partners is an independent investment company historically active in buy-out capital, which expanded its field of intervention to real estate assets in 2008, and has been investing since 2015 in the capital of listed French SMEs/ETIs. as a minority shareholder with an active, friendly and long-term approach. In 2020, Weinberg Capital Partners added its capacity to invest in SMEs/ETIs with a minority strategy focused on sustainable development issues, which offers extra-financial support known as impact, to better prepare companies for environmental and societal challenges.

With €1,3 billion of assets under management, Weinberg Capital Partners is a significant player in the mid-market equity segment in France.

Weinberg Capital Partners is a signatory of the PRI, a member of the International Climate Initiative and an active responsible investor.

Weinberg Capital Partners supports Télémaque, an association for equal opportunities in education.

For more information: weinbergcapital.com.

Follow us on LinkedIn.

About REALEASE Capital

REALEASE Capital is one of the leading independent lease engineering service providers across the IT, medical and industrial sectors. Created in 2012 following the merger between DDL and Comiris Capital, the Group has a presence on the whole French territory through a network of 8 offices (Paris, Lyon, Bordeaux, Nantes, Rennes, Lille, Tours et La Ciotat), and also has operations in Belgium through its office in Brussels. REALEASE Capital manages more than 11,000 contrats weighing more than €500m worth of financed equipment. It generates annual revenues of c. €170m.

For more information: realease-capital.fr.

• Weinberg Capital Partners

Bérengère Beaujean

Communication Manager

berengere.beaujean@weinbergcapital.com

+ 33 7 85 58 29 73

• REALEASE Capital

Céline Caudoux

Marketing & Communication Director

ccaudoux@realease-capital.fr

+ 33 1 75 33 80 18

• Weinberg Capital Partners

Laurence Roy-Rojo

Partner, Investor Relations

laurence.royrojo@weinbergcapital.com

+ 33 6 31 00 51 65